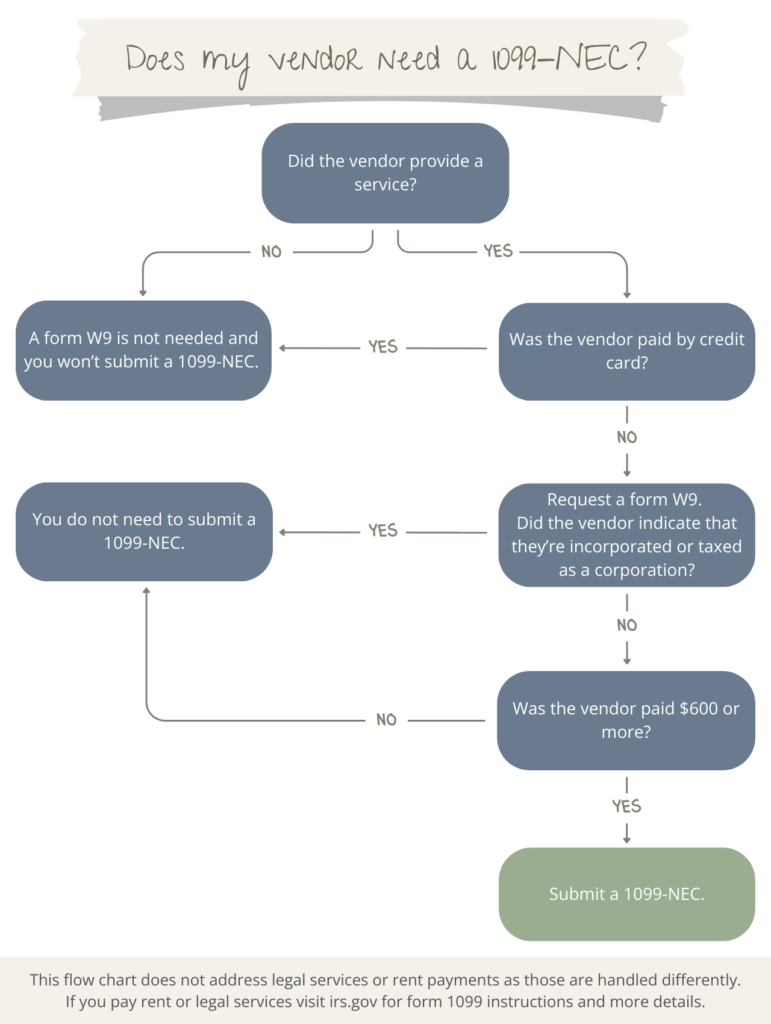

A form W-9 has crucial information for tax reporting and is completed by independent contractors or vendors that provide a service for businesses. The form W-9 helps determine if an independent contractor/service vendor needs to be sent a tax form 1099-NEC at year-end.

We recommend collecting a form W-9 before making the first payment to contractors/vendors so they are motivated to return the form. As people get busy, these forms can become challenging to collect.

A form W-9 is not needed for vendors who provide a product only. For example, a form W-9 is not necessary if someone sells the business cleaning supplies. However, if they sold cleaning supplies and used them to clean an office, they provided a service (cleaning the office) along with a product. In this case, a W-9 would be needed. Businesses are off the hook if the independent contractor/vendor has been paid by credit card. The credit card company will report the contractor/vendor income to the IRS, so there is no need to collect the W-9.

A blank form W-9 and instructions can be found on the IRS website at irs.gov.

Morgan Morrow Bookkeeping is happy to provide guidance on these forms and/or take care of the filings for you.

Copyright © 2024 Morgan Morrow | All Rights Reserved

We’re looking forward to talking.