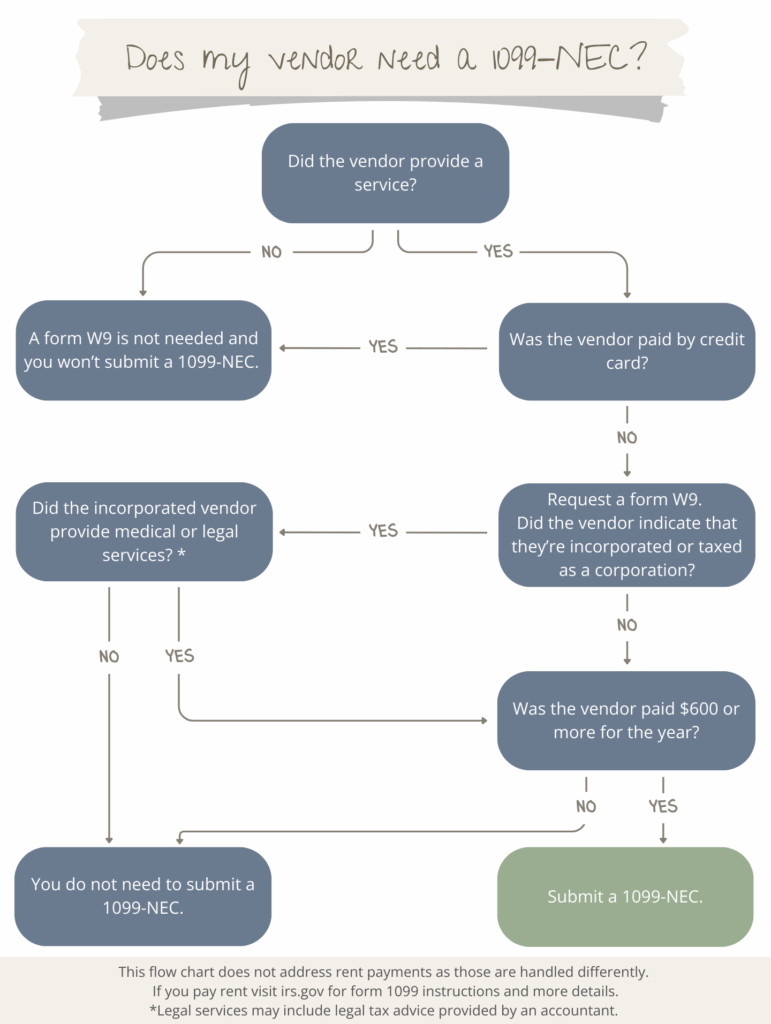

A form 1099-NEC is sent to independent contractors or vendors that provide a service for business owners, such as consulting and repairs. A 1099-NEC provides the independent contractor with proof of income and is also sent to the Internal Revenue Service (IRS). The IRS requires these forms to be sent to vendors that meet certain parameters and will assess penalties if eligible forms are not submitted.

The IRS requires that a 1099-NEC be sent to unincorporated contractors (vendors) who are paid $600 or more to provide a service for the business. Keep in mind an independent contractor can have an LLC designation but may still be unincorporated in the eyes of the IRS. The forms are sent in January for the previous year’s activity.

If the vendor is providing a product only, is incorporated with the IRS, or is paid less than $600 for the calendar year, a 1099-NEC typically is not required. Business owners generally do not need to send a 1099-NEC to independent contractors that identify as C-corporations or S-corporations unless the payment is for legal services. Businesses are usually off the hook if the contractor/vendor was paid by credit card. The credit card company will handle this with a 1099-K.

More information can be found about 1099-NEC requirements at irs.gov or you may contact Morgan Morrow Bookkeeping. We would be happy to answer questions or help with filings.

We’re looking forward to talking.